Read update

- Checked content for accuracy, product availability, and dead links.

Quick Links

Extended warranties are everywhere. But whether it's on a car or an appliance, extended warranties are almost always a waste of money.

UPDATE: 10/18/22

Checked content for accuracy, product availability, and dead links.

The Best Warranty Is a Savings Account

Extended warranties are rarely worth your money. Products don't break on their own, and when they do, the price of repairs is usually lower than what you'd spend on an extended warranty.

Sure, some people have saved a lot of money with extended warranties. That's great! But take a moment to ask yourself why a company would offer you an extended warranty. The answer is: because they're profitable.

According to Warranty Week, a newsletter dedicated to service plans, extended warranties are a $40 billion business. This figure alone indicates that extended warranties are grossly overpriced and rarely used.

In most cases, it's best to skip the extended warranty and use your extra cash to build up an emergency fund. But every situation is different, and some extended warranties are more useful than others. That's why we've researched some popular products that usually offer extended warranties and explain whether it's worth your money.

Extended Warranties for Cars Are Scams

Extended warranties for cars are a giant scam. They don't exist to make people's lives easier, and they're not worth your money. Of course, everyone's situation is different. If you're offered a cheap extended warranty for a car with a lot of mileage, for example, it might be worth going over the pros and cons.

Dealerships offer extended warranties to supplement reduced prices on the showroom floor, to push people into high-interest, low-payment deals at the last second, and to ensure that people go to dealerships (instead of small businesses and competitors) for servicing. On top of all that, dealerships don't always honor extended warranties, and most of the money from them goes toward a dealer's commission, not a vehicular social security program.

The average extended warranty for a car costs between $350 and $750 a year (plus interest, if you add the warranty cost to your loan). And, in most cases, an extended warranty won't cover routine maintenance (which costs less than $100 a year when paid out of pocket and prevents most unexpected breakdowns).

If you take that $350-$700 and stick it in your savings account, you'll have more than enough money to pay for any surprise repairs. If you do run into a problem that's too expensive to deal with (an engine replacement, for example), you can sell your car and use your savings as a down payment on a new one. This way, you also avoid Blue Book depreciation and future breakdowns (after one serious failure, cars tend to suck the money out of your wallet).

However, it can sometimes be worth getting an extended warranty on certain car parts or paint jobs. If you're notorious for ruining tires, for example, a warranty can save you a lot of money the next time you drive on a flat.

Carrier Insurance Is Usually Worth It

Americans break thousands of smartphone screens every hour. While that sinks in, also consider the fact that most smartphones experience charging issues or a reduced battery capacity after just a few years of use. On top of that, phones are getting more expensive. You know where we're going with this.

Due to all of the above, an extended warranty (usually called carrier insurance) for your smartphone is typically worth the extra cost. Some manufacturers will fully replace your phone if it breaks, or they'll cover repairs (broken screens) throughout its lifetime. Even if you don't end up using the warranty, phones are fragile, and it's nice to know you won't have to shell out $1,000 to replace an iPhone that falls on the concrete.

Just make sure that you understand the terms of your extended warranty before you put down any cash. Some carriers won't replace your phone unless it's fully paid off, and others require discounted payments for repairs.

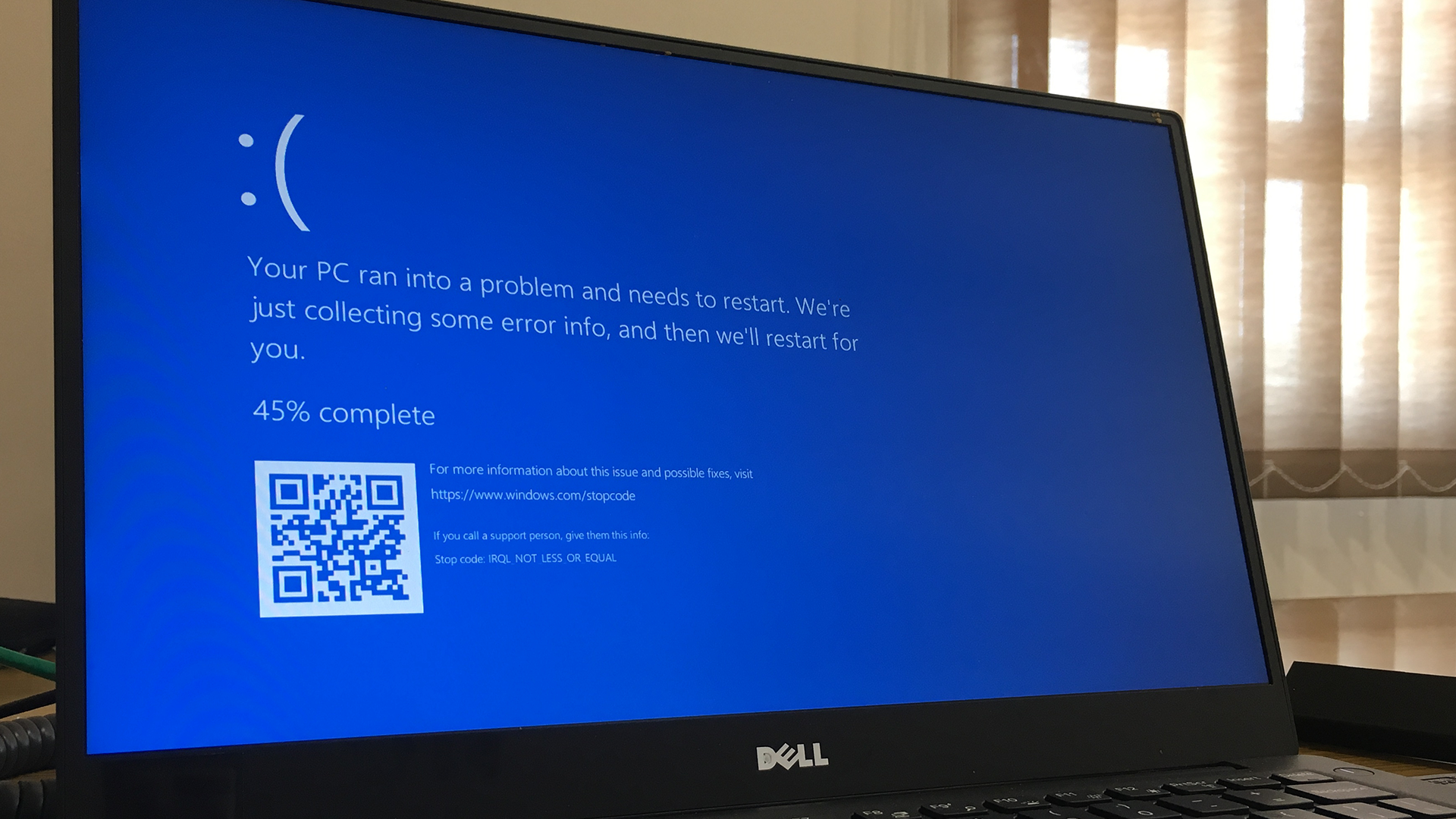

Computers and Electronics Rarely Need Warranties

Retailers like Amazon and Best Buy offer extended warranties for computers and electronics. Like those on cars, these are mostly useless. They exist to supplement discounts and competitive pricing. Best Buy can offer a laptop at a $50 discount if 50% of buyers are willing to pay for a $100 Geek Squad warranty, and so on.

There's no point in buying a warranty for cheap electronics, so we're going to quickly cover why you might (or might not) want a warranty for some expensive electronics:

- Desktop Computers: Computers shouldn't break on their own. If you're afraid your new desktop will break for no reason, spend that extra warranty money on a more reliable computer.

- Laptops: If you're always putting your laptop in risky situations, an extended warranty might be worth the money---just make sure it covers dumb accidents.

- Computer Parts: If something breaks on your computer, it's usually because it's been mishandled. Manufacturer's warranties cover manufacturing defects. So, unless you've got some serious butterfingers, skip the extended warranty.

- Game Consoles: Gaming companies are still squeamish from the red ring of death controversy. So, skip the warranty on your next Xbox. If there are any problems, the manufacturer will probably take care of it for free or at a low cost.

All in all, you don't need to buy extended warranties for computers and electronics. But if you're afraid something's going to break, a warranty might be worth it. If possible, though, consider buying a more reliable product.

Appliances Don't Need Extended Warranties

Nearly one-third of all people buy extended warranties for their appliances and, often, these go unused. When they are used, it's usually for problems covered under the manufacturer's warranty, like failing sensors in fridges or washing machines.

For appliances, manufacturer's warranties tend to cover a decade of use. Plus, home warranties usually cover appliance repairs, and homeowners insurance pays for any covered losses. So, no, you shouldn't buy an extended warranty for your appliances. If you're afraid you'll have to pay for repairs, then put half the cost of an extended warranty in your savings account. That will usually cover a few years of repair work.

Extended Warranties Are Useful for Some Musicians

Let's rip this Band-Aid off quickly---musicians are notorious for abusing expensive equipment. Maybe it's style, or maybe it's genetic temperament, but either way, it's fact.

So, if you're buying musical equipment, an extended warranty might be a good idea. It depends on the kind of equipment you're buying, what you're going to use it for, and what's covered in the warranty.

Avoid warranties that only cover specific parts or forms of product failure. One that covers any accident or abuse is ideal. Avoid warranties that cost too much, as they could expire before you actually break your equipment.

Here's a list of musical equipment and the warranty-worthiness of each:

- Microphones: Because they're incredibly delicate and expensive (especially ribbon mics), a warranty is worth considering. Also, if you tend to be rough with yours and are afraid you might break it, a warranty is probably a good idea.

- Instruments: If you're spending a ton of money on an instrument, it probably won't break. Still, it's worth considering a warranty for fragile instruments you plan to abuse, like wind, brass, or hollow-bodied stringed instruments.

- Amplifiers: Most amps last forever. If they do break, it's often a manufacturing issue covered by the manufacturer's warranty. Also, contrary to what any salesperson might tell you, tube amps are easy to self-service. They rely on tech that's been around for nearly a century, after all.

An emergency fund is usually more cost-effective than an extended warranty. If do you find yourself in a situation where one might be useful, investigate the terms of the warranty and think it over. There's usually a one-week or one-month signup window, so there's no rush.